Insurance Third-Party Administrators (TPAs) Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company's Insurance Third Party Administrators Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 18, 2025 /EINPresswire.com/ -- "The Insurance Third-party Administrators (TPAs) market is dominated by a mix of global insurance service providers and regional administrative specialists. Companies are focusing on advanced claims management solutions, integrated benefits administration, and digital platforms to strengthen market presence and ensure operational efficiency. Understanding the competitive landscape is key for stakeholders seeking growth opportunities, strategic partnerships, and expansion across large enterprises and healthcare providers.

Which Market Player Is Leading the Insurance Third-Party Administrators (TPAs) Market?

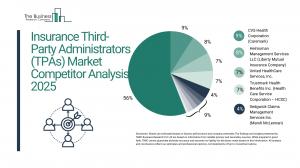

According to our research, CVS Health Corporation (Caremark) led global sales in 2023 with a 9% market share. The Pharmacy & Consumer Wellness division of the company is partially involved in the insurance third party administrators (TPAs) market, provides retail pharmacy operations, dispensing prescriptions, and selling health and wellness products. It also provides ancillary pharmacy services like patient care programs and vaccinations.

How Concentrated Is the Insurance Third-Party Administrators (TPAs) Market?

The market is concentrated, with the top 10 players accounting for 43% of total market revenue in 2023. This level of concentration reflects the industry’s high operational complexity, regulatory requirements, and the demand for reliable, scalable administrative solutions. Leading vendors such as CVS Health Corporation (Caremark), Helmsman Management Services LLC (Liberty Mutual Insurance Company), United HealthCare Services, Inc., and Trustmark Health Benefits Inc. (Health Care Service Corporation) maintain their market positions through advanced claims management platforms, comprehensive benefits administration, and strong client relationships, while smaller firms continue to serve niche sectors. As adoption of digital administration tools and integrated insurance solutions accelerates, strategic partnerships, mergers, and technology-driven innovations are expected to further strengthen the dominance of major players.

Leading companies include:

o CVS Health Corporation (Caremark) (9%)

o Helmsman Management Services LLC (Liberty Mutual Insurance Company) (8%)

o United HealthCare Services, Inc. (7%)

o Trustmark Health Benefits Inc. (Health Care Service Corporation (HCSC) (7%)

o Sedgwick Claims Management Services Inc. (Marsh McLennan) (4%)

o The Cigna Group (2%)

o CorVel Corporation (2%)

o Kaiser Permanente (2%)

o AssuredPartners Inc. (2%)

o Charles Taylor Plc (1%)

Request a free sample of the Insurance Third-Party Administrators (TPAs) Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=18644&type=smp

Which Companies Are Leading Across Different Regions?

North America: Equisoft Inc., Emma Insurance Inc., VIP Universal Medical Insurance Group (VUMI Canada), SEB Administrative Services Inc., DeepIntent Inc., CoverGo Limited, Elysian Insurance Services LLC, Patra Corporation, Drawbridge Partners LLC, MDM Insurance Services Inc., UnitedHealthcare Insurance Company, Sutherland Global Services Inc., SelectHealth Inc., UCHealth Plan Administrators Inc., Marpai Inc., Charles Taylor plc, The Matrix Companies LLC, Aegis Corporation, CanAm Insurance Services (2009) Ltd., Group Medical Services (GMS) Insurance Inc., Green Shield Canada (GSC), Grupo Nacional Provincial S.A.B. (GNP), MetLife México S.A., HealthSmart Holdings Inc., HMS Holdings Corp., Benefit Allocation Systems LLC (BAS), TPA Solutions LLC, TRISTAR Insurance Group Inc. (TriStar Insurance Services), Sedgwick Claims Management Services Inc., Milliman Inc., Pinnacle Claims Management Inc. and BenefitMall Inc. are leading companies in this region.

Asia Pacific: Beijing Foreign Enterprise Human Resources Service Co., Ltd. (FESCO), ERGO Group AG, Wilbur-Ellis Company, Paramount Health Services and Insurance Third Party Administrator Private Limited, Medi Assist Healthcare Services Limited, Symetri Limited, Exide Life Insurance Company Limited, HDFC Life Insurance Company Limited, Bajaj Allianz General Insurance Company Limited, Reliance General Insurance Company Limited, Bharti AXA General Insurance Company Limited, The People's Insurance Company of China (PICC), Ping An Insurance (Group) Company of China, Ltd., China Pacific Insurance (Group) Co., Ltd., AIA Group Limited and China Life Insurance Company Limited are leading companies in this region.

Western Europe: Claims Corporation Network Group, Afa Insurance (Afa Försäkring), Homecare Insurance Limited, Heddington Insurance (UK) Limited, Guarantee Protection Insurance Limited, Gringolet Company Limited, Aviva plc, AIG Life Limited, Allianz SE and Simplesurance GmbH are leading companies in this region.

Eastern Europe: Signal Iduna Group, Garanta Asigurari S.A., PIB Group, STEIN Besting GmbH, Punkta GmbH, MAXIMA Pojistovna TPA Services, WARTA Claims Service Sp. z o.o., PZU Pomoc S.A., Kooperativa Pojistovna TPA Services, Unilink S.A., Allianz-?iriac TPA Services and VSK Insurance Group TPA Services are leading companies in this region.

South America: Crawford & Company, Sedgwick Claims Management Services, Inc., UMR (a Marsh McLennan company), CorVel Corporation, HealthSCOPE Benefits, Maritain Health, EXL Service Holdings, Inc., Alankit Limited, Arthur J. Gallagher & Co., Charles Taylor Limited, Chubb Limited, Mercado Pago, Inc. and CNP Assurances S.A. are leading companies in this region.

What Are the Major Competitive Trends in the Market?

• Innovations in AI-driven insurance claims management is transforming operational efficiency, support data-driven decision-making and deliver personalized assistance.

• Example: Wilbur suite of AI and analytics tools (September 2024) assigns tailored to integrate seamlessly with Wilbur's existing platform, aiming to enhance claims processing efficiency, minimize fraud, and optimize underwriting practices

• These innovations prevent automating tasks like document verification and fraud identification these tools streamline claims management, expedite settlements, and enhance customer satisfaction.

Which Strategies Are Companies Adopting to Stay Ahead?

• Expanding provider network partnerships to improve service accessibility and reduce claim settlement time

• Implementing advanced claims analytics and automation tools to enhance accuracy and reduce operational costs

• Strengthening data security and compliance frameworks to manage sensitive policyholder information and meet regulatory standards

• Optimizing customer experience platforms through omnichannel support, chatbots, and real-time claim tracking systems

Access the detailed Insurance Third-Party Administrators (TPAs) Market report here:

https://www.thebusinessresearchcompany.com/report/insurance-third-party-administrators-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.